salt lake county sales tax rate

The latest sales tax rate for South Salt Lake UT. New values on properties are available from the Assessors office.

Texas Sales Tax Rates By City County 2022

Salt Lake Valley Health Dept.

. Tax deeds for properties purchased at tax sale will be issued by the first part of July. Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835. The County sales tax rate is.

Salt Lake County Treasurers Office tax codes asdfasd fgkdchkjgafhgbjkdsjhkda. LS Local Sales Use Tax CO County Option Sales Tax MT Mass Transit Tax MA Addl Mass Transit Tax MF Mass tran Fixed Guideway CT County Option Transportation HT Highways Tax HH County Airport Highway Public Transit AT Transportation Infrastructure SM Supplemental State Sales Use Beaver County 01-000 470 100 025 595. If the Salt Lake City School District a taxpayer entity providing a taxpayer service approved an operational budget of 75000 and the total taxable value of all property in the Salt Lake City School District was 15000000 then if you live in that school district the tax rate for the year would be calculated and show up on your official.

The Utah sales tax rate is currently. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other publications found here. Wayfair Inc affect Utah.

UT is in Salt Lake County. 2020 rates included for use while preparing your income tax deduction. The December 2020 total local sales tax rate was also 7250.

Auditors office will start accepting property valuation appeals August 1 through September 15 2022. Did South Dakota v. While many other states allow counties and other localities to collect a local option sales tax Utah does not permit local sales taxes to be collected.

The December 2020 total local sales tax rate was also 7250. Utah has 340 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Utah has a higher state sales tax than 538 of.

The Salt Lake Sales Tax is collected by the merchant on all qualifying sales made within Salt Lake. Salt Lake City is in the following zip codes. You can print a 775 sales tax table here.

East Riverton Drainage. Welcome to the Salt Lake County Property Tax website. The Utah state sales tax rate is currently.

The minimum combined 2022 sales tax rate for Salt Lake City Utah is. The current total local sales tax rate in Salt Lake County UT is 7250. 91 rows This page lists the various sales use tax rates effective throughout Utah.

Any property unsold at the Tax Sale and which is not in the public interest to be re-certified to a subsequent sale shall become county property. The 775 sales tax rate in Salt Lake City consists of 48499 Utah state sales tax 135 Salt Lake County sales tax 05 Salt Lake City tax and 105 Special tax. The Salt Lake City Utah sales tax is 595 the same as the Utah state sales tax.

There are a total of 131 local tax jurisdictions across the state collecting an average local tax of 2108. Utah has recent rate changes Thu Jul 01 2021. The latest sales tax rate for Salt Lake City UT.

This is the total of state county and city sales tax rates. The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. The Auditors office calculates certified tax rates for all entities in the county that levy property taxes.

The total sales tax rate in any given location can be broken down into state county city and special district rates. South Salt Lake Details. The Salt Lake Utah sales tax is 685 consisting of 470 Utah state sales tax and 215 Salt Lake local sales taxesThe local sales tax consists of a 135 county sales tax and a 080 special district sales tax used to fund transportation districts local attractions etc.

The current total local sales tax rate in North Salt Lake UT is 7250. See Publication 25 Sales and Use Tax General Information. Select the Utah city from the list of cities starting with A below to see its current sales tax rate.

Avalara provides supported pre-built integration. The Salt Lake City sales tax rate is. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

If you would like information on property owned by Salt Lake County please contact Salt Lake County Real Estate at 385-468-0374. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. Notice of Value Tax Changes will be sent from the Auditors office by mid-July.

What is the sales tax rate in Salt Lake County. The minimum combined 2022 sales tax rate for Salt Lake County Utah is. Cities towns and special districts within Salt Lake County collect additional local sales taxes with a maximum sales tax rate in Salt Lake County of 775.

Skip to main content. The certified tax rate is the base rate that an entity can levy without raising taxes. The various taxes and fees assessed by the DMV include but are.

2020 rates included for use while preparing your income tax deduction. What is the tax rate in Salt Lake County. Puerto Rico has a 105 sales tax and Salt Lake County collects an additional 135 so the minimum sales tax rate in Salt Lake County is 61999 not including any city or special district taxes.

This rate includes any state county city and local sales taxes. The Salt Lake County sales tax rate is. This is the total of state and county sales tax rates.

The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. The Salt Lake City Sales Tax is collected by the merchant on all qualifying sales made within Salt Lake City. In other words it is the rate that will produce the same amount of revenue that the entity.

The county-level sales tax rate in Salt Lake County is 035 and all sales in Salt Lake County are also subject to the 485 Utah sales tax. For tax rates in other cities see Utah sales taxes by city and county. This rate includes any state county city and local sales taxes.

The South Salt Lake Utah sales tax is 705 consisting of 470 Utah state sales tax and 235 South Salt Lake local sales taxesThe local sales tax consists of a 135 county sales tax a 020 city sales tax and a 080 special district sales tax used to fund transportation districts local attractions etc. North Salt Lake Details North Salt Lake UT is in Davis County. 274 rows Lowest sales tax 61 Highest sales tax 905 Utah Sales Tax.

Average Sales Tax With Local. 7705 or email to taxmasterutahgov. To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824.

What is the sales tax rate in Salt Lake City Utah. North Salt Lake is in the. With local taxes the total sales tax rate is between 6100 and 9050.

You may also call the Tax Commission at 801 297-7705 or toll free at 1-800-662-4335 ext. The 2018 United States Supreme Court decision in South Dakota v. Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335.

State Local Option. Weed Debris.

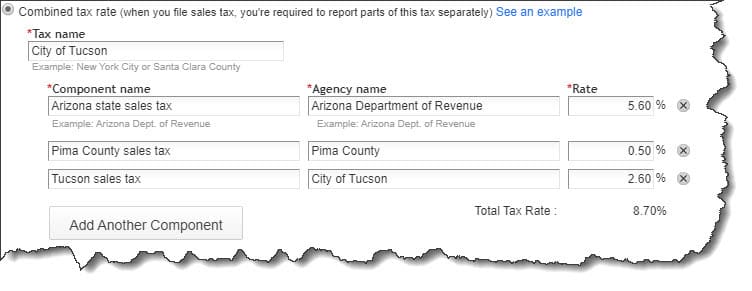

5 Things You Need To Know About Sales Tax In Quickbooks Online

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Salt Lake City Utah S Sales Tax Rate Is 7 75

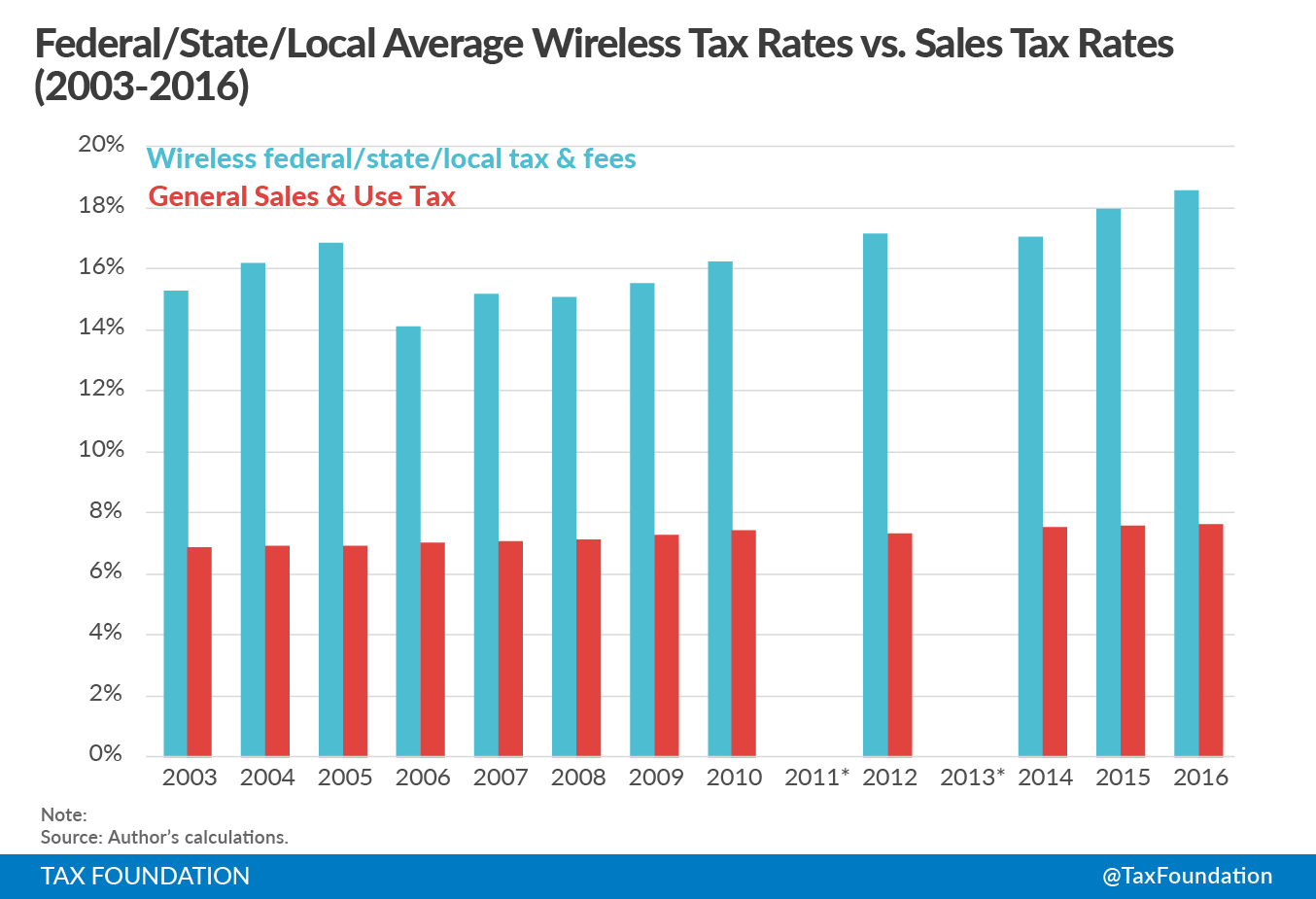

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Utah Sales Tax On Cars Everything You Need To Know

The Utah Income Tax Rate Is 4 95 Learn How Much You Will Pay On Your Earnings

Utah Tax Rates Rankings Utah State Taxes Tax Foundation

Utah Sales Tax Small Business Guide Truic

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

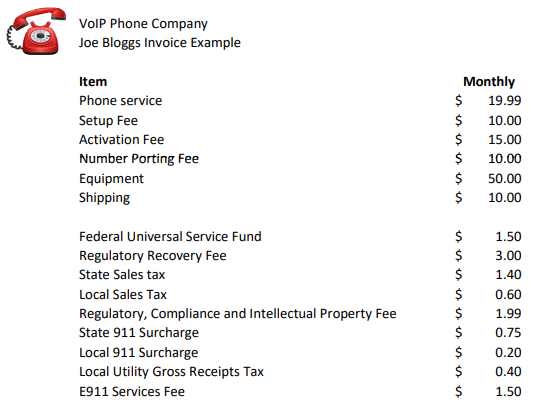

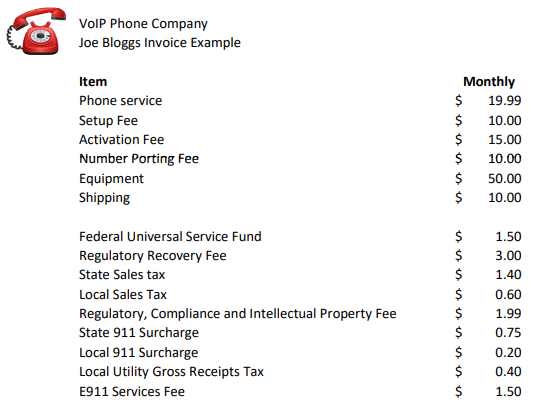

Voip Pricing Taxes And Regulatory Fees Explained

Taxes In Orem Utah Orem Sales Tax Rates And Orem Property Tax Rates Orem Ut The Best Guide To Orem Utah

Quarterly Sales Tax Rate Changes

Sales Tax On Grocery Items Taxjar